Posts

Here are some all of our guide to your thread cost, rates, and productivity for much more about precisely how bond rates change over date. Ties try financing bonds where an https://johnylab.net/ investor gives currency so you can an excellent organization or a national to possess a flat time frame, in return for regular desire money. While the thread has reached readiness, the bond issuer productivity the brand new buyer’s money.

- But not, an excellent bondholder are selling its ties in the open business, the spot where the rate is also fluctuate.

- Business B things a few-12 months cards for the March step one, 2018, and therefore cost $five hundred every single pay six%, on the basic percentage produced half a year after the topic date.

- Deals in the shares from ETFs can result in broker profits and you may will create taxation effects.

- Now you finest understand the part ties play within the a good collection, you may then consider investment that will help realize the wants.

- Essentially, since the industry interest levels increase, a bond’s rates decreases.

Can i Sell My Bonds Through to the Readiness Day?

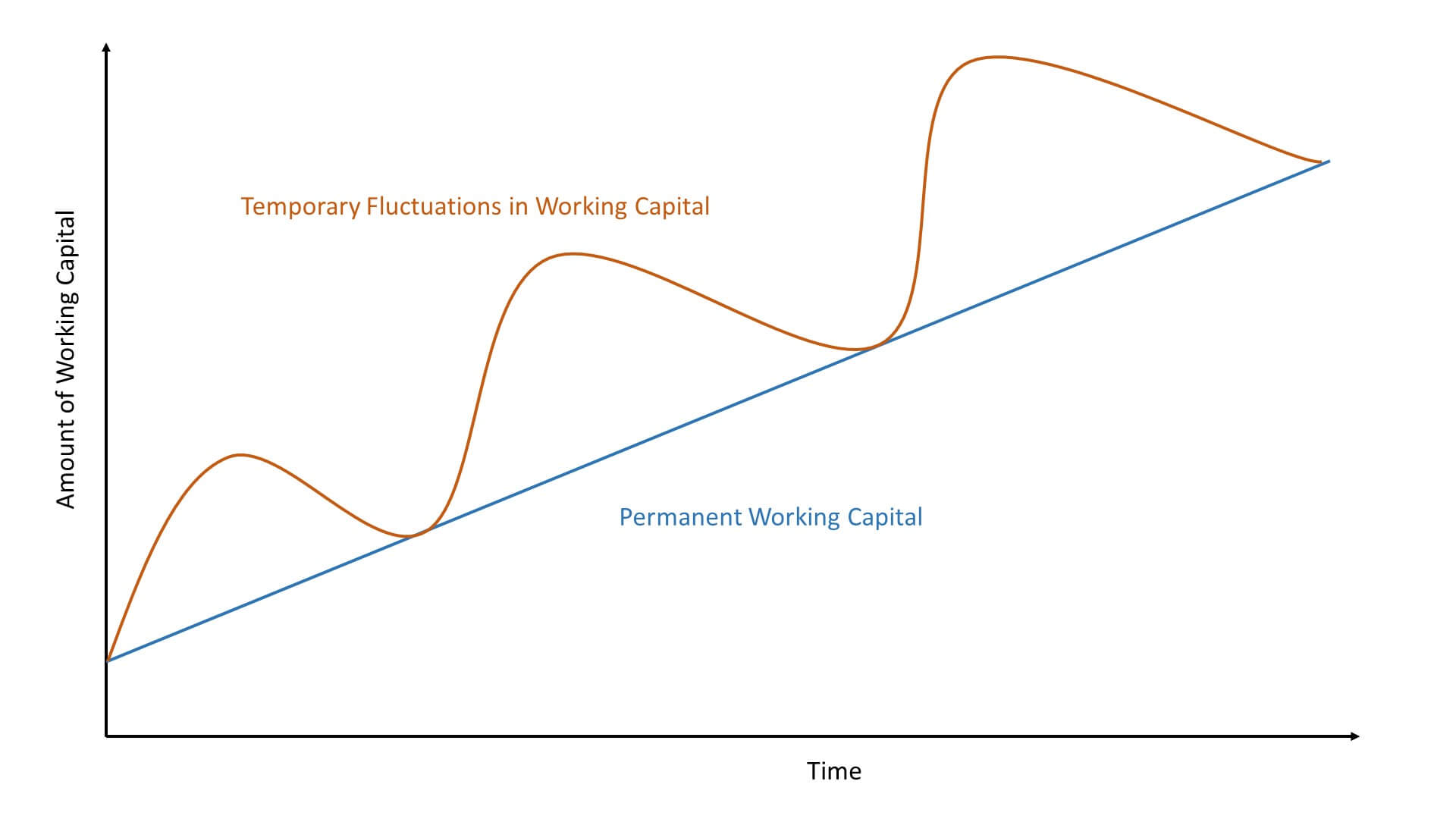

It will go up and you will down centered on rates of interest, the company’s credit history, and you will business request. A thread’s benchmark speed ‘s the interest rate you to definitely find the variable focus costs. They changes from time to time so that the bond’s yield reflects current market conditions and handles traders facing focus rate change. The risk is that rising prices can also be corrode the actual worth of repaired interest repayments and you will principal over time ultimately causing reduced to buy power. Fixed rate securities can offer an investor a reliable income stream when it comes to attention money. Fixed costs try contractually required and you will generally generated annually otherwise semi-a year, bringing a predictable and credible source of income.

Although not, they may hold a trip risk, meaning the new issuer is also repay the text before its readiness time. Very first, they give a stable and more predictable earnings stream of normal interest repayments. This makes them attractive to those individuals looking for uniform production.

Treasuries history month, it turned to ties within the Japan and you can Germany. This time, the fresh Treasury offer-of is actually followed closely by investors leaving ties across the multiple biggest areas. Wednesday’s terrible You.S. auction efficiency were combined by the economic concerns about The japanese and the U.K., whose main banking institutions try against growing stress to keep interest rates highest amid rising prices and you can paying leaps. In the You.K., rising prices popped more requested last week, when you are Japanese investors forced the speed away from get back they really want so you can give compared to that country to accounts perhaps not present in twenty five years.

Finding out how they disagree and the matchmaking amongst the costs out of bond bonds and you may market interest levels is essential before using. This can help make sure your own bond alternatives align with your economic requirements and chance threshold. You might purchase bonds thru number 1 places or secondary areas. First areas will be the community forums in which governing bodies and you can firms matter personal debt directly to traders for the money.

Trick Factors to have Bond Investors

All of the managed money companies are required to help you spreading portfolio growth so you can investors. A thread who has a variable coupon one occasionally resets founded for the a short-name interest rate, for instance the Secure Immediately Financing Rates (SOFR) and/or give for the step 3-month Treasury debts. Of several people could see bonds while the a safe haven asset classification designed to balance out their carries, but their part is more nuanced than simply one to. Organization Separate Membership and Separately Managed Accounts are given from the affiliated money advisors, which give funding advisory features and do not sell securities.

- Because of the complete trust and you may support of the U.S. bodies, these represent the safest you can thread opportunities.

- The fresh Treasury ended up selling $16 billion worth of 20-seasons securities, as well as the auction compensated having a 20-season Treasury give more than 5%, signaling people try demanding high rates to hold All of us personal debt.

- While the income away from a civil thread finance try exempt away from federal taxation, you could are obligated to pay taxation to the any financing growth know from the fund’s change otherwise during your own redemption from offers.

- The fresh supplementary marketplace is composed of bonds that were awarded in the the past that will getting replaced until redeemed because of the issuer.

Change Bonds

There’s no warranty one to a working trade market for offers away from an ETF will build up or even be maintained. Invesco Suppliers, Inc. ‘s the All of us dealer for Invesco’s Retail Issues, Collective Trust Finance and you can CollegeBound 529. Invesco Financing Administration LLC ‘s the investment agent for Invesco’s ETFs. Invesco Tool Investment Trusts is provided by the brand new sponsor, Invesco Money Segments, Inc. and you can broker traders in addition to Invesco Vendors, Inc. The entities is indirect, entirely possessed subsidiaries out of Invesco Ltd.

By the Spending Objective

This type of ties are typically granted because of the shorter organizations which have riskier team designs or because of the governing bodies having a reduced ability or determination in order to pay off traders. A good bondholder might not desire to hold a bond up until its identity comes to an end, carrying out the possibility that a trader is’t sell it quickly or at the a reasonable price. So it liquidity chance is gloomier to have authorities bonds and you will highly rated corporate securities, that have energetic additional segments. However, it’s high to possess lower-rated much less aren’t traded securities. A fixed speed bond is basically that loan to your issuer in return for typical attention payments.

Treasury ties are long-label opportunities given by U.S. regulators. These bonds is actually backed by the newest You.S. and you can, for this reason, is actually regarded as most safer. With their reduced chance, they supply lower efficiency than many other kind of ties. Yet not, whenever market attention rises, the prices of these lengthened-powering and lower-producing securities will come quickly under some pressure. Ties are economic tools one people get to earn desire.

To purchase Ties since the Investments

As opposed to that have carries, there are teams you to speed the caliber of for each and every bond by the delegating a credit history, you know how likely it’s which you can get the requested repayments. Such as, when you spend money on securities, you will get desire payments in the bond’s issuer. Whether or not you decide to work with a financial elite or self-manage your assets, fixed-income assets will likely be a core section of your spending method. Inside a highly-diversified investment profile, bonds is also render one another balances and you may predictable income. Thread common financing and ETFs try in an easier way to gain access to for informal people.